Why Oil and Energy

Welcome to the world of investment insights with our new “Why Series”. Join us as we unravel the driving forces behind some of our strategies and stay tuned for a series of captivating themes unfolding over the coming weeks.

At One + One Wealth Management, our current investment philosophy is grounded in strategic thinking and forward-looking insights. As seasoned wealth managers, we hold a steadfast belief in the enduring potential of oil and energy investments. In times of elevated inflation, these sectors have historically demonstrated robust performance, serving as a reliable hedge against inflation and, at times, as an engine for long-term portfolio growth. We invite you to explore the compelling reasons illustrated and narrated below, as to why we firmly believe that, in our current economic climate, investments in oil and energy are strategic and positive additions to our clients' portfolios.

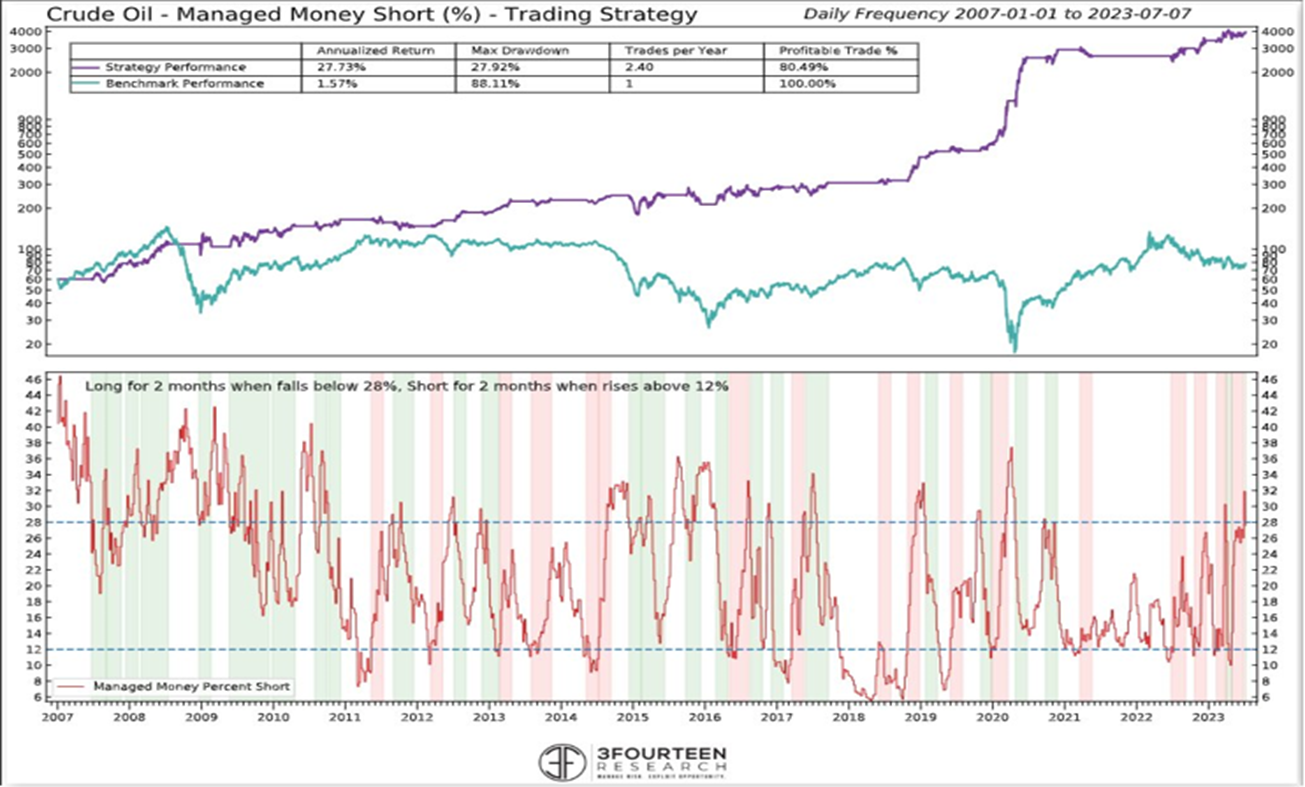

Short-term, oil has triggered a 2-month Buy Signal based upon Managed Money/Hedge Fund Short positioning. They are significantly net short which has historically acted as an excellent contrarian buying opportunity. (Chart below)

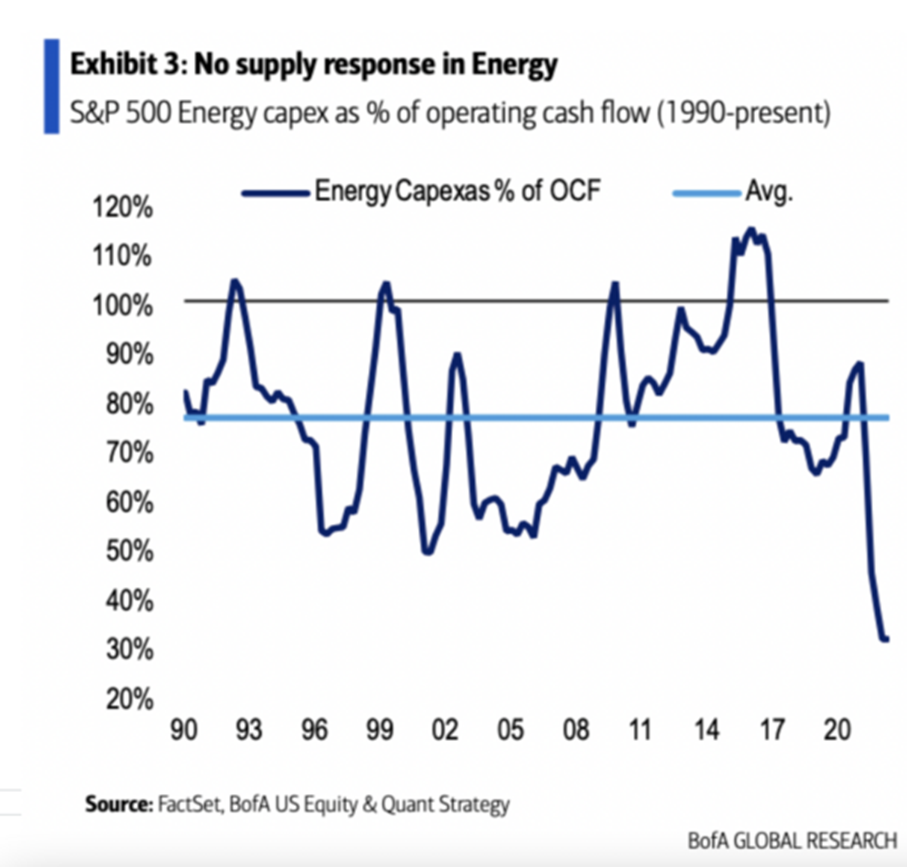

Below is a history of pullbacks in oil prices over the past 20+ years. The current pullback aligns more with the pullback during 2000 when there was “Historically Low Capex Among Producers” versus prior pullbacks of the larger variety which coincided with “Historically High Capex Among Producers” or the COVID Pandemic.

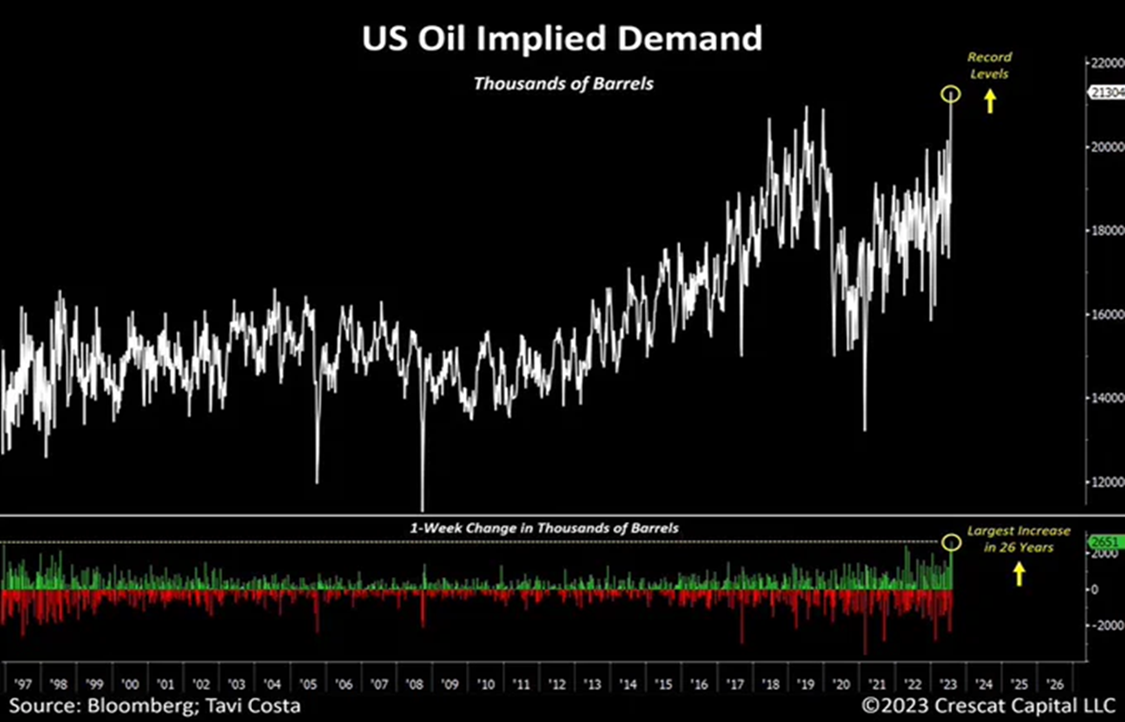

Take the above chart's illustration of very low capital expenditure and add to that the surging and sustained implied demand for oil (as shown in the chart below). Recently, there was the largest weekly increase in 26 years, all while US oil production remains at approximately 7% below pre-pandemic levels. Furthermore, inflation continues to be deeply ingrained within the system, further supporting a potential long-term rally in the oil/energy sector. Remember Economics 101: supply and demand. With supply and capital expenditure low, and demand high, it creates a double whammy effect, priming prices for an increase.

The below chart illustrates the lack of investment in new oil supply. Oil producers due to ESG (Environmental/Social/Governance) and regulatory constraints are instead choosing to divert these monies back to shareholders via enhanced dividends and share buybacks driving excellent shareholder returns. So, with global demand for oil still growing and producers reducing potential supply, it has created significant depletion of current inventories and sets the stage for the potential of significantly higher oil prices. All good news for the shareholders of these companies.

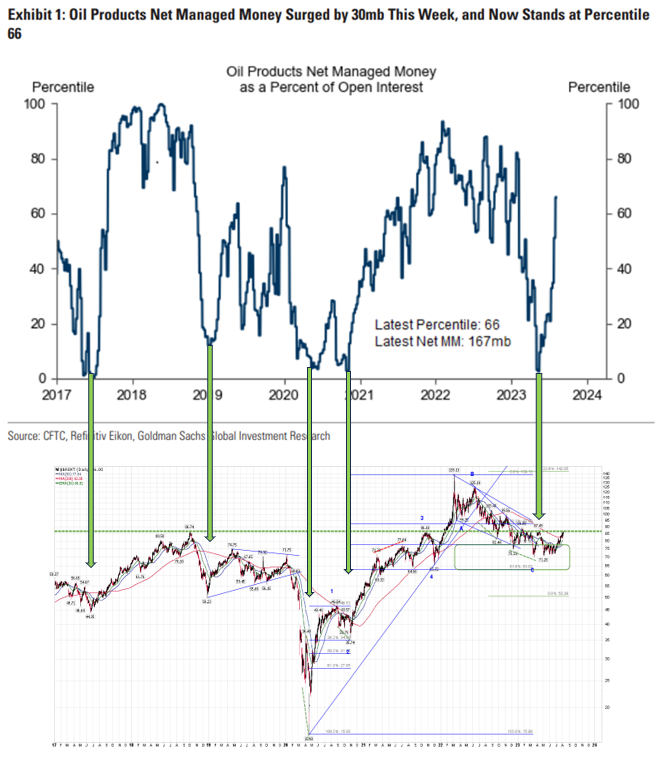

Goldman Sachs Net Managed Money positioning is a useful indicator to help assess when Oil is “over-owned” or “under-owned”. We just tripped a recent “under-owned” signal which marked the recent low and the beginning of the new uptrend for oil prices. Current positioning is only in the 66th percentile and not indicative of the end of the recent rally. Pullbacks should still be bought until we hit the 90th percentile. Side by side you can see the historical correlation between this indicator and the positive movement in oil. (Green arrows below)

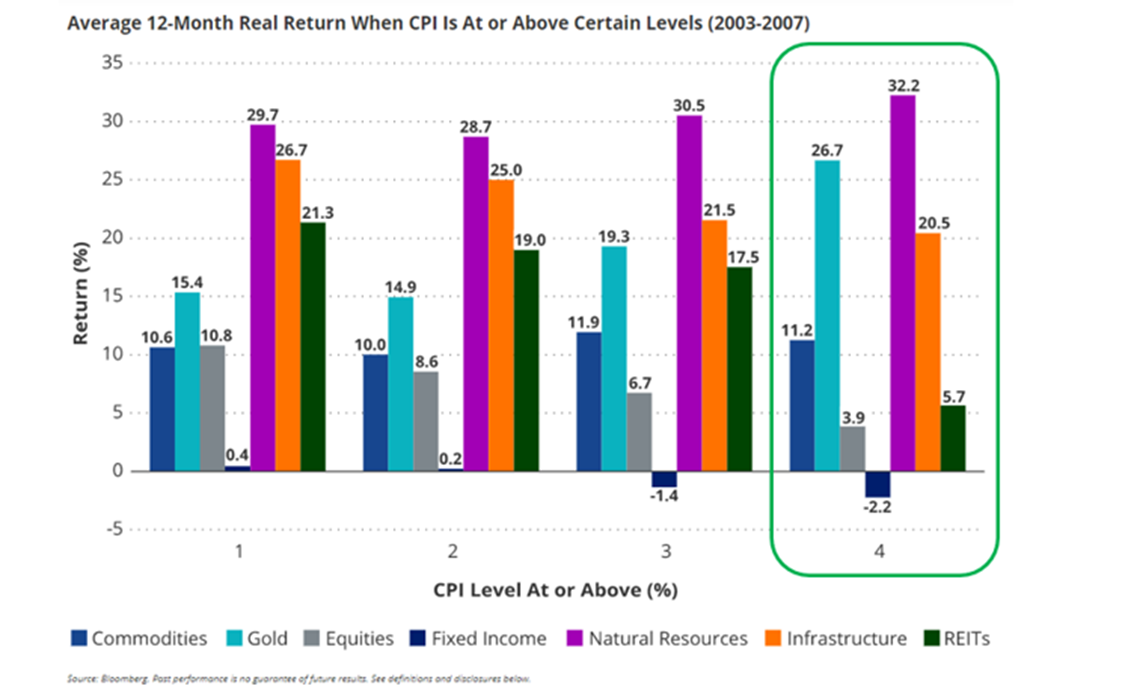

Want more...? We now have oil producers and oil services companies trading at rock bottom valuations but generating some of the best earnings and free-cash flow growth in the overall market by far. Below illustrates historical return performers among various asset classes during the last major Energy/Commodity up-cycle in the mid-2000’s. Looking at the chart below, we can see that the Real Return (return in excess of inflation) during this period, which has many similar characteristics to today, was greatest for Natural Resources and Infrastructure investments (these two categories encompass energy investments) at 20-30% excess returns per year when inflation averaged 3-4% or more. The inflationary 1970’s also saw Energy, Commodities and Natural Resources investments generate very outsized returns as well.

It makes you wonder why investors are so focused on the last decades Tech winners which are over-valued and over-owned when the investment characteristics of the Energy space are so attractive.

**Reminder that past performance is not an indication of future performance**

We are also bullish precious metals, value and commodities in general. Keep an eye out for our next “Why Series” covering commodities.

As always, please contact us to learn more and how we can help navigate and optimize your portfolios during today's market chaos. Additionally, let us know of specific topics of interest you'd like us to address.